AI risk platform for fraud and compliance teams

Welcome Dwarkesh listeners!

Learn why risk teams turn to Sardine when they need to stay ahead of fast-moving, AI-powered attacks.

Sardine provides modular building blocks to manage risk across the entire customer journey. And with the introduction of AI agents across core workflows from customer onboarding to payments and account protection, Sardine enables organizations to stay ahead of increasingly sophisticated attacks. Learn why risk teams turn to Sardine when they need to stay ahead of fast-moving, AI-powered attacks.

Connect with our team

不正行為とコンプライアンスの最新情報を知る

-p-1600.png)

Fake job applicant fraud - Is your candidate actually an AI fake?

A rising tide of fake job applicants using sophisticated techniques like VPNs and...

Deepfake Detection: A guide for Trust & Security Teams

Deepfakes and synthetic media are now showing up in everyday fraud queues. Attackers are using AI to generate faces, documents, and videos that look real enough to pass basic checks, and they are using them across onboarding, liveness, support calls, and claims.

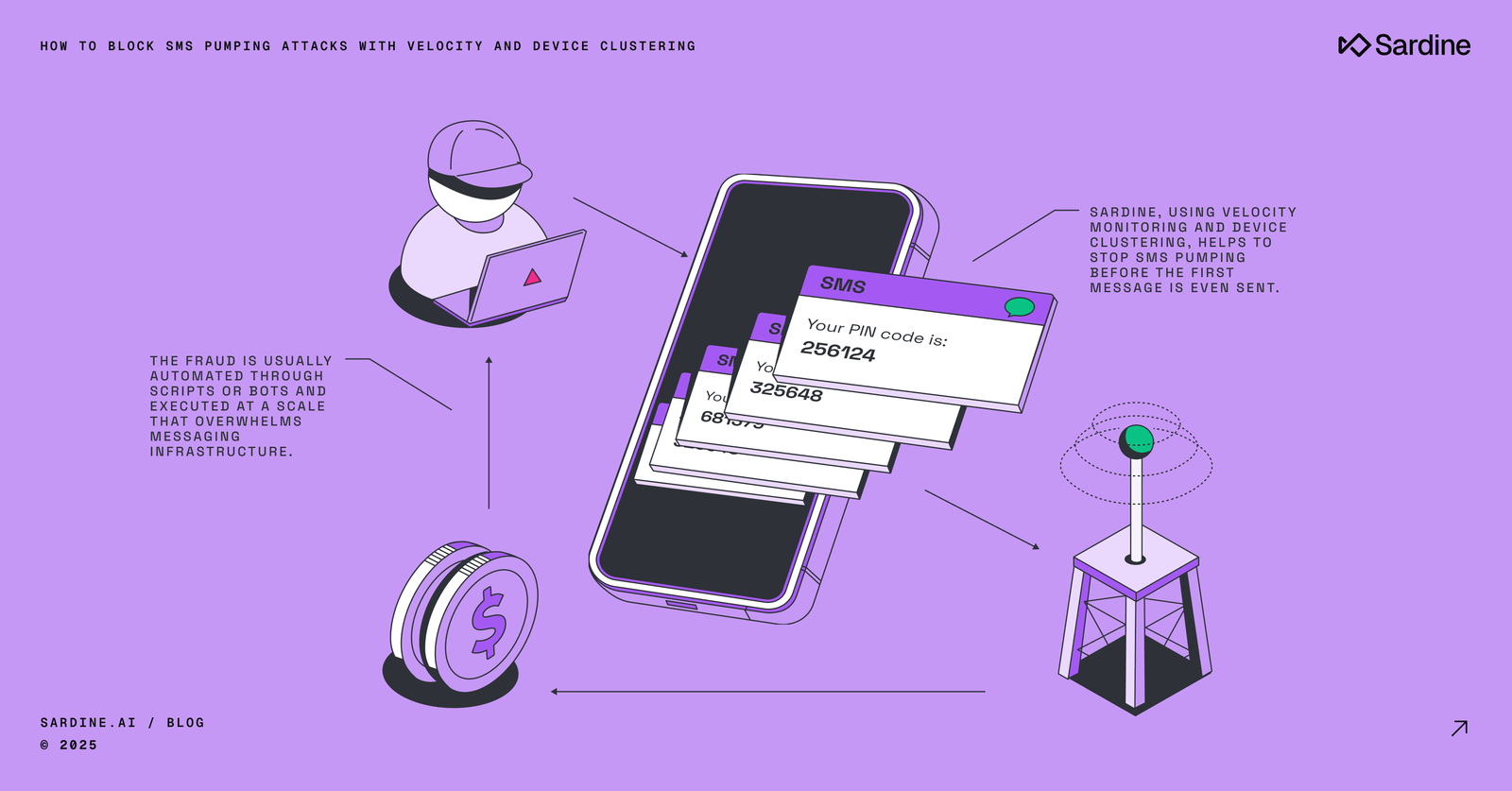

How to detect and stop SMS pumping fraud

SMS pumping is a fast-growing fraud attack that exploits OTP and 2FA flows to generate

ML を中核とするデータ駆動型プラットフォーム

.png)

行動ベースのインサイトを活用して不正行為を未然に検出

正規の顧客を煩わせることなく、リスクの高いユーザーを早期に特定し、隠れた脅威を発見できます。

デバイスと動作

疑わしいマウスの動きを示したり、長期記憶フィールドのコピーアンドペーストを行ったり、VPN、エミュレーター、リモートアクセスツールを使用したりしているリスクの高いユーザーを検出します

継続的モニタリング

すべてのセッションを監視して、詐欺の兆候がないか確認します。アカウント作成、ユーザーオンボーディングから、銀行口座のリンク、支払い、入金/出金、ログインまで、さまざまなプロセスを網羅しています。

トゥルーピアス™

高度な難読化技術を用いて不正行為者の正体を明らかにし、身元、所在地、IP、ブラウザ、オペレーティングシステム、さらにはマーチャントリスク評価まで明らかにする

Modern tools to streamline risk management

A complete picture of your customer’s risk

- View all the signals captured and rules fired across a user’s entire session history from account creation

- Customer details - device, behavior, email, phone, DOB, account age, and connections across Sardine network

- Any sanctions, PEP, or Adverse Media hits

Customer Dashboard

Easily build automated risk assessment workflows

- Build conditional execution paths for credit underwriting and stepping up risky users for documentary KYC

- Easily connect to external data sources, such as bureaus and identity verification consortiums

- Combine with Sardine’s behavioral and device signals

Workflow Builder

Take down organized fraud rings in one-click

- Uncover suspicious connections between users, devices, IP, phone, email, and cards that may indicate scams

- Quickly take down entire fraud networks and stop users from abusing policies around promotions and refunds

- Supports 314(b) eligible institutions to share data and collaborate on case investigations

Connections Graph

Streamline reviews and case management with GenAI

- Bulk dispositioning, full audit trail, escalation logs

- Integrated into FinCEN for seamless SAR/CTR filing

- GenAI copilot makes your analysts more efficient by converting text into SQL rules, and writing SAR narrative and activity reporting summaries

Case Management