.webp)

Leading banks, online retailers, and fintechs use Sardine to automate risk decisioning, catch more fraud, detect money laundering, and protect their customers from scams.

Proprietary device intelligence and behavior biometrics unmasks fraudsters to stop all forms of financial crime.

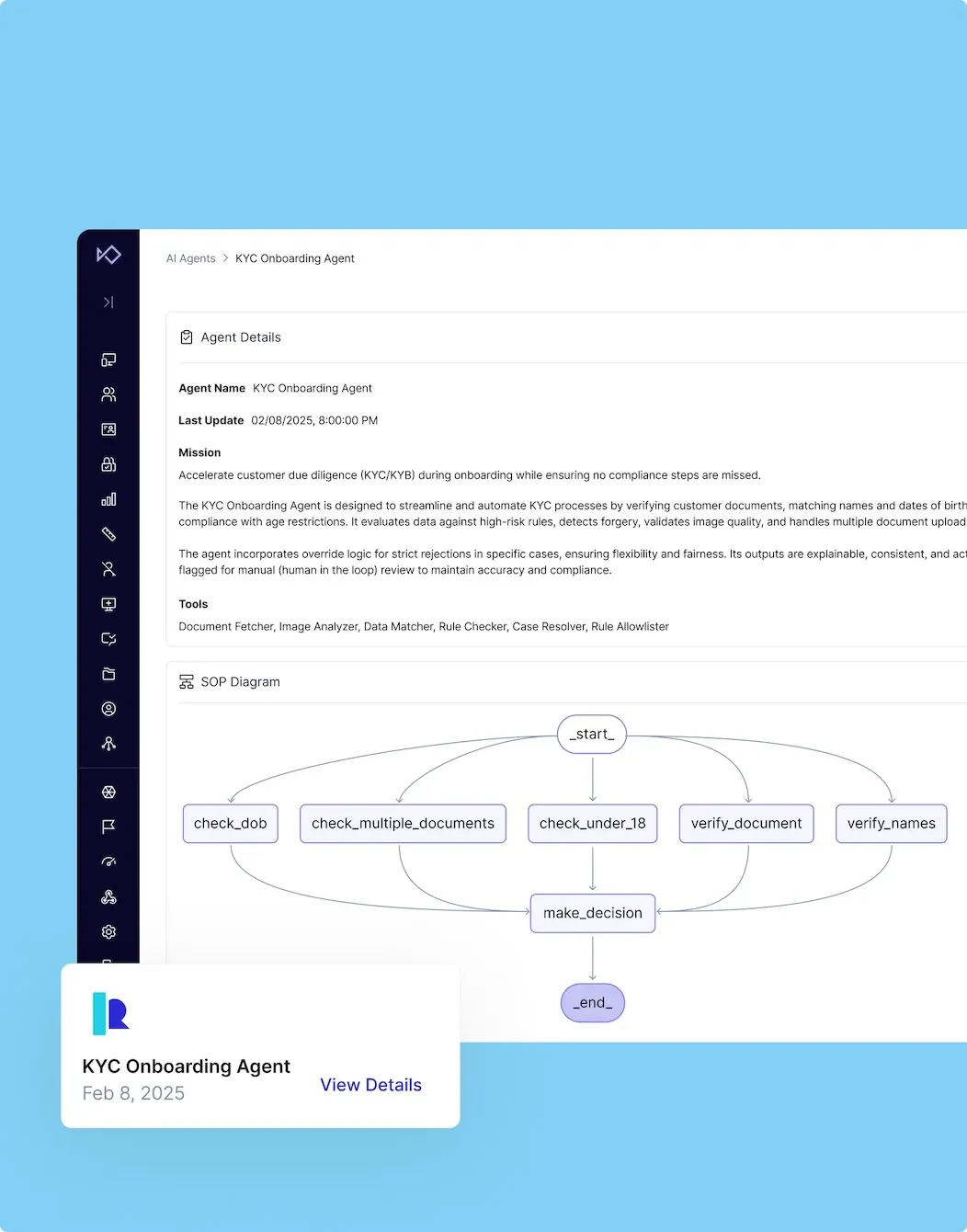

Detect stolen and synthetic identities to prevent fake account sign ups, money mules, and onboarding fraud.

.jpg)

Perform customer due diligence (CDD), business verification, sanctions screening, and document verification in one platform.

Verify bank account ownership and risk levels in real-time to prevent fraud during account funding, deposits, and withdrawals.

Block fraudulent card and bank payments. Predict and prevent chargebacks and ACH returns in real time.

Detect and take down complex, illicit money movement. Streamline case management and SAR/UAR filings.

Detect 70+ sophisticated bots to stop carding attacks, credential stuffing, web scraping, reseller bots, and fake accounts.

Protect your customers from social engineering tactics like pig butchering, crypto advisor, deep fakes, and voice cloning.

Ultra low latency risk scoring to help card issuers prevent unauthorized CNP/CP transactions, and stop BIN attacks.

Predict default and audit risk, automate manual underwriting, and leverage alternative data to approve more loan applicants.

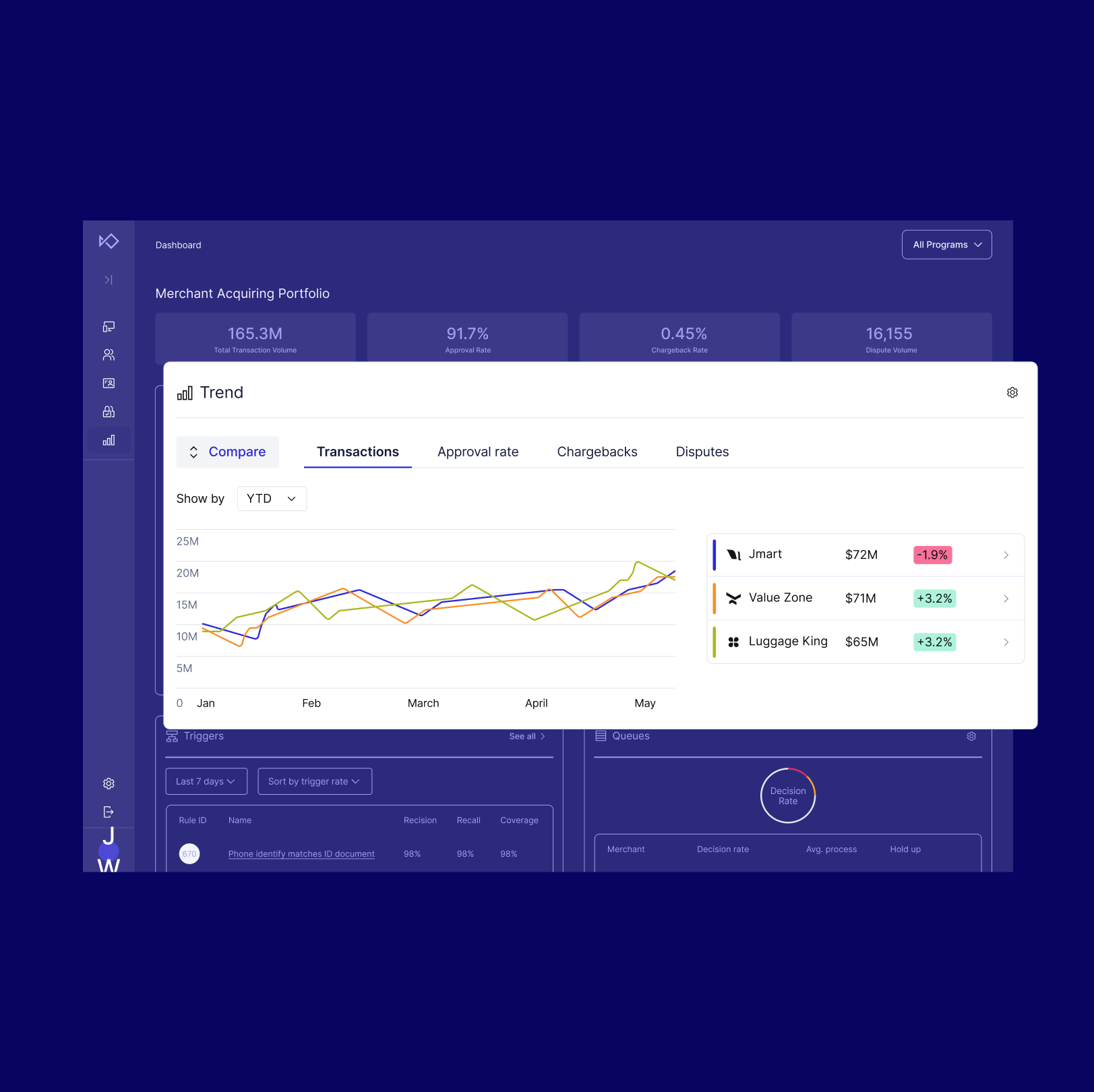

Onboard more good merchants, reduce portfolio-wide chargeback rates, and protect yourself from bust-out fraud..

Monitor and enforce controls (fraud, compliance) across all of your fintech programs and their customers in one solution.

Identify high risk users early and uncover hidden threats without introducing friction to legitimate customers.

.webp)

.webp)

Today, Novo has a best-in-class chargeback rate of 0.003% on their issued debit cards. With over $1B in monthly transaction volume, they received less than $26K in fraudulent chargebacks.

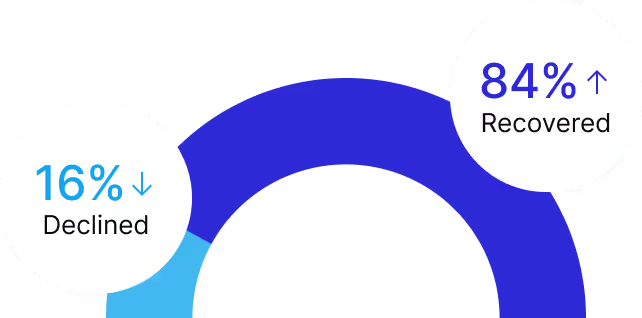

Reduced auto-declines on high-risk users with our card fraud ML model – prompting 2FA/OTP to approve more legitimate transactions.

.webp)

Stop the surge of social engineering scams and defend against threats like buyer-seller collusion, money muling, authorized push payment (APP) fraud, and bot attacks.